Want to learn how to file a successful mold insurance claim? This article offers some tips for navigating the process.

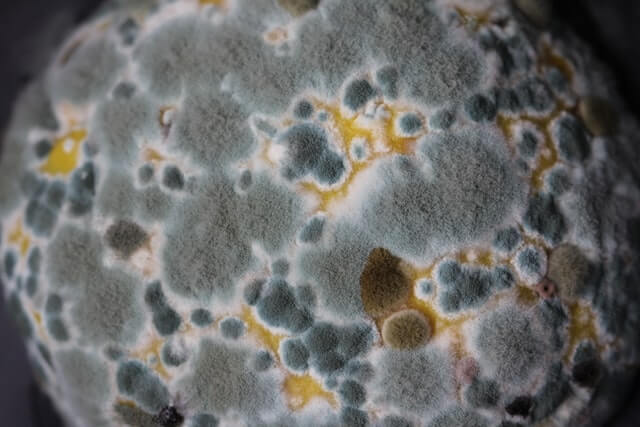

Most homeowners neglect to take mold seriously until it becomes an expensive problem. Not only can mold remediation be expensive, but mold is also hazardous to your health and the health of your family. If you think that you may have a mold problem in your home, here are a few things you need to know when you make an insurance claim.

Understand Your Policy

One of the first steps you should take after discovering mold in your home is to review your insurance policy. Take out your copy of your policy and turn to the section on declarations. In this section of your insurance policy, you can find your coverages, coverage limits, and an overview of the process of filing a claim.

After you have reviewed and understood your policy’s mold coverage, the next step is to determine if you have a covered peril. This is important because your carrier will require that a covered peril be related to your mold loss. You can then determine whether you have a valid claim.

Make Sure Your Policy’s Coverage Limits Are Sufficient

Mold remediation services can be expensive and most policies have a specific limit of coverage, and if your policy’s coverage limits are low, you need to make sure your carrier is applying the limits correctly.

It is important that only the costs of mold removal are applied to your policy’s mold limits. For example, only drywall damaged by mold—as opposed to water damage—should be applied to the total for your mold remediation limit. Next, the rebuild/replacement of damages caused by mold should be covered under your regular coverage A portion of your policy, and not your mold. In some cases, mold remediation will only account for a fraction of the repair cost. The rest would be considered the replacement cost of the home.

Make a successful mold insurance claim with help from an expert. Contact Murphy E.T.C Consulting today to learn how.

Keep Your Mold Problem from Growing Worse

As soon as you notice mold in your home, you have a responsibility to ensure that the problem does not spread or grow worse. If a leaking pipe caused the mold, turn off the water to that pipe or fix the leak. If a leaky roof caused the growth, you need to do a temporary repair so that more moisture does not continue to infiltrate your home’s interior.

Furthermore, do not make any permanent repairs until you have contacted your carrier and given them an opportunity to inspect your loss. Always document the damage to your home before you make any repairs, temporary or permanent so that you can give it to your carrier upon request. Do not throw away any damaged materials, either, as they are evidence that can support your claim (the damage is the body in the crime scene). Take plenty of pictures and save them in multiple locations to protect them from being lost.

Want to Make a Successful Mold Insurance Claim? Work with an Expert.

Getting the full value for your mold claim can be difficult if you are not familiar with the insurance claims process. Want to get the most compensation possible for your claim? Working with an expert public adjuster could help you maximize the value of your claim.

Get in touch with Murphy E.T.C Consulting today to set up an appointment. We are ready to help you out!